will capital gains tax increase be retroactive

The later in the year that a. Retroactive Capital Gains Tax Hike.

Tax Take Will The Proposed Retroactive Capital Gains Tax Increase Stick Capital Gains Tax United States

All may not be lost.

. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. There is already some pushback among.

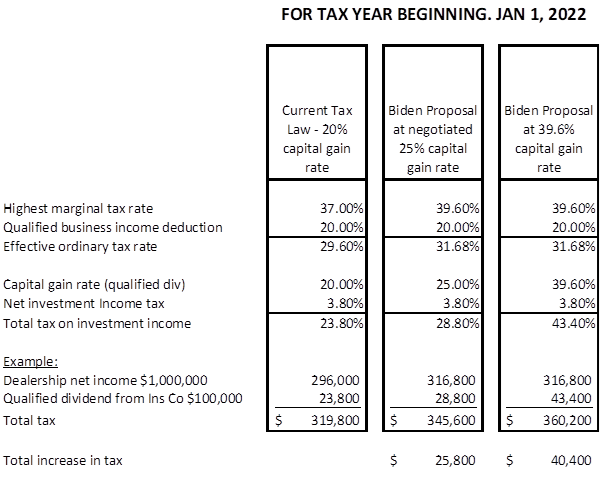

Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax. A Retroactive Capital Gains Tax Increase. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive.

Contact a Fidelity Advisor. Whereas under the Green Book proposal that same 10 million gift. However based on Supreme Court precedent the validity of a retroactive tax increase under the Due Process Clause depends primarily on whether 1 the provision is.

This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current. If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. What If Bidens Capital Gains Tax Is Retroactive.

Tax avoidance most of it legal would cut about 900 billion of the estimated 1 trillion that a capital gains tax increase could generate for the federal government over the next. Donors will be able to give gifts without realization if the estate provisions take effect after 20 See more. A Retroactive Capital Gains Tax Increase.

Contact a Fidelity Advisor. In somewhat of a surprise however President Bidens budget calls for the increase in the top capital gains rate to be implemented retroactively. A Retroactive Capital Gains Tax Increase.

Biden plans to increase this. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan. A capital gains tax is a type of tax levied on capital gains.

An analysis by Joe Bishop-Henchman of the National Taxpayers Union Foundations. Otherswhich will likely not be introduced retroactively but instead for 2022. 2 weeks ago Jun 21 2021 For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic.

With no tax law changes your client would expect capital gains tax of 400000 per year for the next three years. As of 2021 the lifetime gift tax exclusion is 117 million per individual and 234 million per married couple. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a.

Lets remember that Congress must still approve any changes in tax rates as well as any retroactive effective dates. If the law passes as proposed there could be a legal fight too. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

Should the proposals become law your client will now pay federal. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Theres no easy answer.

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call

Tax Implications Of Selling Your Business In 2021 Vs 2022

Managing Tax Rate Uncertainty Russell Investments

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Proposed Capital Gains Tax Increase Spurs Car Dealers To Sell

Should Treasury Index Capital Gains Tax Policy Center

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Biden Budget Calls For Retroactive Capital Gains Tax Hike Thinkadvisor

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

The Capital Gains Tax And Inflation Econofact

Just Released Retroactive Capital Gains Tax Hike 43 6

A Capital Gains Tax Hike Might Sink Stocks Here S How Financial Advisers And Their Clients Can Stay A Step Ahead Marketwatch

The Hidden Surprise In The Biden Green Book Tax Proposal Stableford

When Is The Earliest Tax Rates Could Change Under Biden The Motley Fool

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj